Quant Insight (Qi), a quantitative financial market analytics and trading insights provider based in the Middle East, today announces the launch of iQbyQi, a new product empowering retail traders in Europe and the Middle East with institutional grade analytics, currently reserved for the world’s top asset managers and hedge funds.

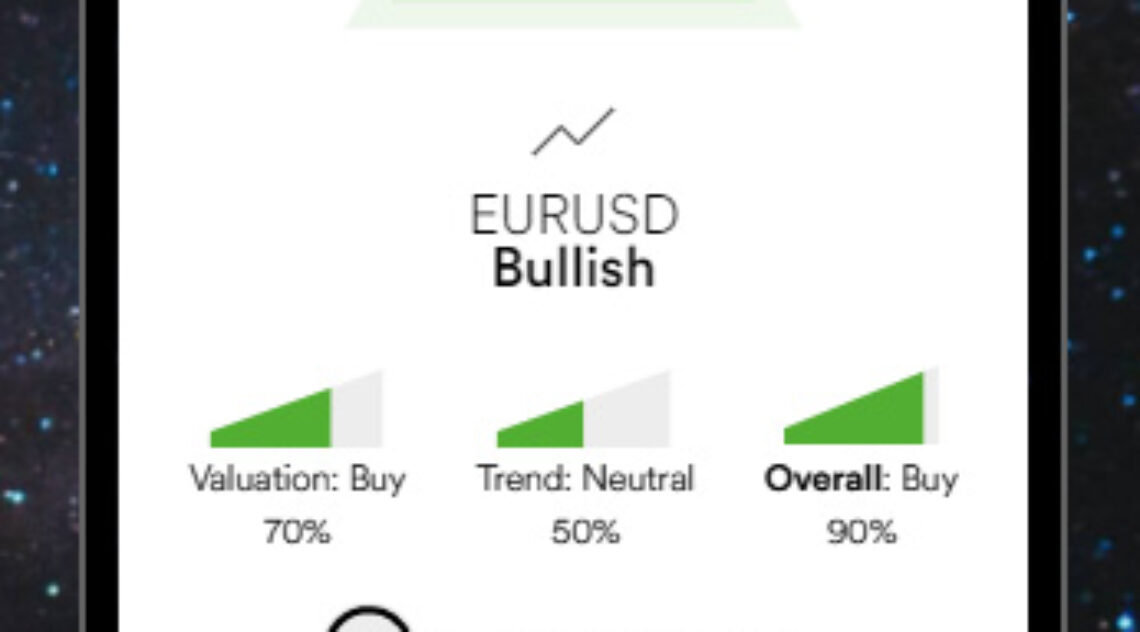

iQbyQi uses a cloud-based AI “market brain” which analyses millions of data points in real time, understands how they are all connected to market prices, highlights opportunities and risks, then broadcasts ‘insights and analytics’ tailored specifically to individual traders.

The product is being launched in Cyprus as Limassol is world renowned as a Forex hub for retail traders, and is well located to allow them to target adjacent nations, such as United Arab Emirates and Israel, as well as European territories.

Mahmood Noorani, Co-Founder and CEO for Quant Insight comments:

“Key information moves markets. It’s all connected and overwhelming and it is impossible for the human brain to parallel process all this data and information.

“Institutional investors have always had access to cutting edge technology, tools and resources such as Qi. However, the trend towards democratisation is accelerating and the launch of iQbyQi designed for individual traders is another key marker on that path.

“iQbyQi, has levelled the playing field, offering retail traders a real opportunity to make better investment decisions. Individual investors now have access to a new level of insight and analysis backed by AI, machine learning and data science. Armed with this unique insight into the macro-forces driving asset prices, individual investors will be better equipped to identify key market opportunities and risks. This is a far cry from the myriad of subjective, conflicting, and often confusing opinions and comments that flood retail investors every minute.”

Individual traders are becoming a greater force in financial markets. Indeed, this trend accelerated over the Covid 19 outbreak in 2020. According to a recent Charles Schwab survey, 15 per cent of all retail investors began investing in 2020, and retail investors’ share of total equities trading volume is now approaching 25 per cent, up from 20 per cent in 2020, and 10-15 per cent the previous decade. In fact, by March 2021, retail trading accounted for almost as much as mutual funds and hedge funds combined.

The retail revolution is here to stay, as technology makes it easier to trade and access information, and DIY investing becomes the norm. Retail investors have flocked to easy-to-use share trading platforms such as eToro, which signed up 3.1 million new registered users in the first quarter of 2021. In October 2021, trading platform Robinhood reported 22.5 million user accounts with money in them, a 130% spike from 9.8 million in the same quarter last year. There were 7.2 million such accounts in March 2020, the company said.

However, it’s no secret that 60-80 per cent of individual online trading accounts lose money. That is out of every 10 traders, only 2-3 traders succeed. Regulatory bodies around the world have expressed concern and are calling for investor education and empowerment to help them successfully build wealth for the long term and make informed investment decisions.

iQbyQi will be available through online brokers in Europe and the Middle East as a first step. Retail investors will receive iQbyQi insights and analytics, in real time. Those insights and analytics provide them with clarity on how security prices are impacted by macro forces allowing them to make better investment. All asset classes from FX to single stocks, indices, commodities, crypto, and futures are covered.

Up until this point, Quant Insight has used its ‘world-first’ technology to provide unique macro insights to some of the world’s best known investment banks, hedge funds and asset managers, including Alan Howard of Brevan Howard. With offices in London, New York, Singapore and Limassol, Qi has clients with a combined total Assets Under Management (AUM) of over $2.5 trillion incorporating Qi’s analytics in their investment process.

Zahi Younan, the CEO of Quant Insight Europe, commented:

“For too long the investment world has relied on a mixture of subjective research, educated guesses and an abundance of data that has made accurate decision-making impossible. It is our key aim to help retail investors make sound investment decisions that will protect their investments.

“iQbyQi is the antidote to a world where retail traders are swamped by countless subjective opinions leading to nothing but confusion; an antidote based on the power of data science, Ai and machine learning for better investment decisions.”

Quant insight has been at the forefront of machine learning and technology, developing the first financial market brain that ingests millions of data points in real time and extracts signal from noise ensuring its clients are ahead of the macro curve. Qi offers a single robust quantitative framework that delivers unprecedented, previously impossible, transparency across macro.

Quant Insight is led by experienced macro hedge fund portfolio managers and leading academics in machine learning and signal extraction from Cambridge, Harvard, and Princeton, in addition to best-in-class data engineers with backgrounds from world leading technology firms.

For more information, please visit the iQbyQi landing page, here: https://www.iqbyqi.com/